Uk Gambling Tax Revenue

- Uk Gambling Tax Revenue Forms

- Federal Gambling Tax Rate

- Uk Gambling Tax Revenue 2019

- Uk Gambling Tax Revenues

- Uk Gambling Tax Revenue Reporting

In general, no UK gamblers/traders will pay tax on their winnings. They are Tax Free. The Inland Revenue has now shifted to onus of any tax liable, to be paid by the companies, bookmakers, and trading outlets – such as Betfair, and this takes a whole heap of pressure of the punters/gamblers. New 21% Point Of Consumption Tax For Remote Gambling in 2019. The UK chancellor, Philip Hammond, announced in his budget in 2018 that the a higher rate 21% point of consumption tax will now be imposed for online gambling on 'games of chance', up from 15%.

Gaming in many of its forms is perfectly legal in the UK through licensed operators. Stepping into a betting shop and placing a bet on a football game is practically a sport in itself in the UK.

People play the lottery, head down to the local bingo centre, have a spin on the fruit machines at the pub, and place plenty of online bets through sophisticated and fun apps and websites.

Of course, with such a large gaming industry, the government is sure to get a piece of that sweet, sweet gaming pie. The UK taxes companies that offer online gambling services to people living in the UK, whether the company is located in the UK or not.

Let’s take a look at what they are taxing and how much they’re gaining from this lucrative trade.

Taxation of online gambling for UK-based companies

Taxation of online gambling in the UK by UK-based companies can fall under a number of different duty categories. While you might think that online bingo would be covered under Bingo Duty, it’s actually classified as Remote Gaming Duty and taxed at 15% of profits. The same goes for online casino gaming, like the casinos over at BossCasino. Lotteries are charged under Lottery Duty, at 12% of all stake money played and payable within the accounting period.

Taxation of online gambling for offshore companies offering betting in the UK

Under UK law, non-UK companies offering betting and/or gaming services to people living in the UK need to register with HM Revenue and Customs, as well as pay tax. There are a few exemptions.

For these offshore companies, they will be required to pay one or more of the following taxes: General Betting Duty, Pool Betting Duty, or Remote Gaming Duty.

General Betting Duty is derived from the profits from general or pool bets that are made by UK customers on horse or dog racing, or bets placed through an offshore betting exchange. The rates for GBD are:

- 15% for fixed odds and totalisator bets

- 3% for financial spread bets

- 10% for all other spread bets

- 15% of the commission charges charged by betting exchanges to users who are UK people

(source)

Pool Betting Duty is derived from profits made on bets that are not fixed odds and not to do with horse or dog racing. This type of tax is charged at 15% of profits.

Remote Gaming Duty is paid by operators for remote gaming profits on bets and games by UK customers, including casino games, freeplays and bingo. Remote Gaming Duty is also 15%.

Do gamblers have to pay tax on their winnings in the UK too?

Under UK laws, there is no taxation on any winnings from betting – meaning if you place an online gambling bet and win a fortune that you can keep every sweet penny of it and none of it has to go to the tax man. The previous taxation required on winnings was done away with way back in 2001. Some other countries and jurisdictions are far more strict. For instance, in Vegas, the rate is 30% for overseas visitors, and 25% for winning for citizens over $5000.

How much is the UK making from online gambling overall?

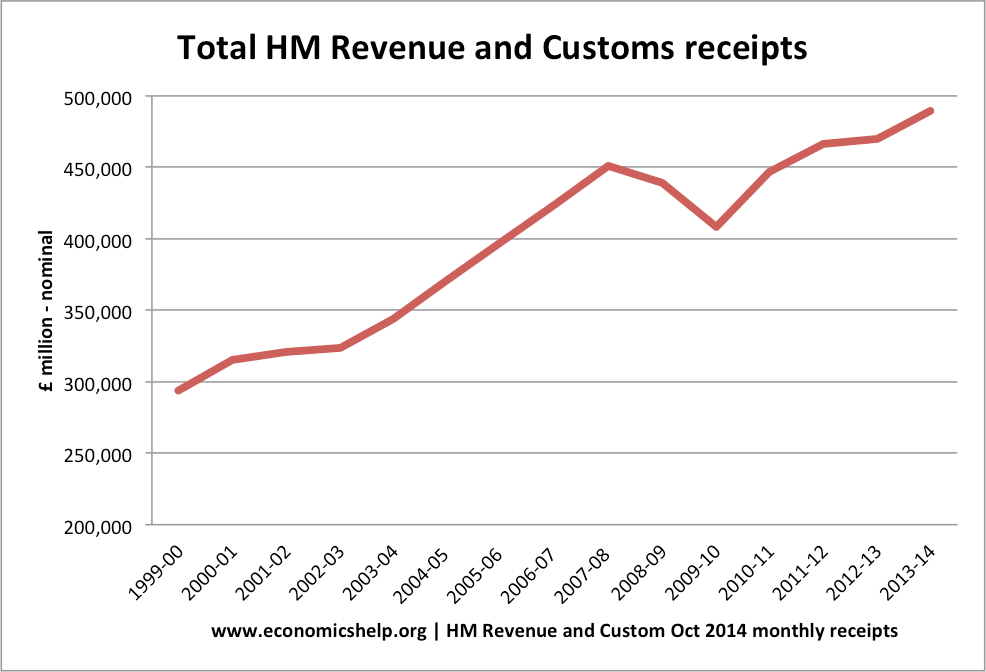

According to Statistica, betting and gaming tax receipts from the UK hit £2.7bn in 2017, over double the amount that it was just 10 years ago. While this figure doesn’t distinguish between in-person and on-premise bets compared to online gambling, this is a hefty figure.

In a report from the UK Gambling Commission in 2017, it says that remote gambling is the largest sector within the gambling industry, accounting for 34% of the overall market, with a gross gambling yield for the year standing at £4.7bn, with slot games making up a majority of this figure at £2.6bn.

If we take 15% of that original number of £4.7bn (15% being the taxable rate), we’ll see that it amounts to £705mn for the year. That’s a whole lot of money going back into the country’s coffers from remote gambling and the figure is only expected to climb with more and more companies offering services and more and more players getting in on the action.

When you think about it, 15% being fairly much the standard across the board for online gambling taxes in the UK isn’t really that much. Income tax rates for individuals in the UK are far higher, 20% and more, unless you’re earning under £11,850 per year, when it is 0%. £705mn only amounts to funding for one major infrastructure works project in the UK.

The taxation rates for online gambling in the UK are fair and the profits made by the government from this activity aren’t as staggering as you might have thought. However, it’s still an industry on the rise so we may as yet see this taxation profits heading up into the billions very, very soon.

The UK is raising its point-of-consumption (POC) gambling tax from 15 percent to 21 percent. The news came in the form of a recent adjustment to the annual UK Government budget.

Here’s an excerpt from the overview:

“A behavioural adjustment has been made to take into account changes in spending on remote gaming in response to this policy, and to account for changes in operator behaviour.”

The UK expects to generate an extra £1.23 billion ($1.56 billion) from the increase over the next five years.

US states with legalized online gambling — and those looking to regulate the industry — should pay close attention to this change. According to the document, “this measure will impact on individuals or households through a change in odds” if operators pass the tax increase on to players.

Uk Gambling Tax Revenue Forms

UK has the experience to get tax rates right

The last 10 years have seen the proliferation of gambling regulation in EU member states, which has been accompanied by studies that explore the impact of taxes. They show a clear correlation between tax rates and the proportion of players drawn into the regulated market.

After four years of operation under the POC system, the UK Gambling Commission (UKGC) believes that the overwhelming majority of online poker, sports betting and casino traffic flows through regulated sites.

With an established industry, the UK is now confident it can raise taxes without pushing players into the black market. Some continental peers, by comparison, see as much as 40 percent of their players sticking to offshore, unregulated poker rooms.

Studies also link the amount of gambling revenue directly to the rate, showing that taxes over 20 percent don’t generally result in gains.

Should US states shoot for similar taxes?

In a presentation to two subcommittees of the Illinois legislature, Rep. Lou Lang tackled the issue head-on. “It’s important to do it right, rather than quick,” he said, speaking about sports betting regulation. Otherwise;

“You make a real mess as Pennsylvania did.”

Lang went on to explain that the 36 percent tax on sports betting was a big mistake in Pennsylvania. “If this industry is taxed too high,” he said, “illegal betting continues.”

New Jersey has a tax rate of 17.5 percent for NJ online poker and casinos, while online sports betting is taxed at a rate of 14.25 percent. Both numbers include mandatory additional taxes for redevelopment and other state industries. Nevada has even lower rates of 6.75 percent for both online poker and sports betting.

If the UK has analyzed the situation correctly, both states should have the freedom to raise taxes to a similar level.

New Jersey and Nevada are distinct markets, of course, and what applies to the UK doesn’t necessarily apply to them. But all three markets have followed a similar path. They began with rates well below 20 percent, a sweet spot that attracts players away from the black market. And they already have high rates of channeling to the regulated market.

It’s entirely possible raising tax rates might not drive players back to the offshore sites in these established markets, either.

Federal Gambling Tax Rate

Uk Gambling Tax Revenue 2019

Raising taxes is easier than reducing them

Pennsylvania faces the opposite problem. It is poised to open interactive gaming with tax rates that are already an impediment to converting offshore players.

Italy offers a correlating example there, having launched its regulated online sports betting industry under an untenable tax. The rates were calculated as a percentage of the total amount wagered, rather than on the revenue operators received. In 2015, the system was changed to a flat rate of 22 percent of gross gaming revenue — a rare example of tax rates being reduced.

Uk Gambling Tax Revenues

The online gaming industry in France has failed to gain support for a similar change, though.

French regulators calculate taxes for poker games as a percentage of each pot — whether or not there’s a flop. This has resulted in online poker operators paying the equivalent of 37 percent of their gross gaming revenue.

Uk Gambling Tax Revenue Reporting

Sure enough, online poker began to decline soon after it was first regulated in France. Revenues have increased only in the period since shared liquidity linked France and Spain.

What’s the bottom line?

In short, there are three European lessons to follow for Pennsylvania and other states that want to get gambling tax and regulation right:

- Start with tax rates that will channel the highest percentage of the market to regulated sites.

- Don’t increase taxes until the market is stable.

- Don’t increase taxes much above 20 percent.